panda2.ru

Prices

How Frequently Can You Apply For A Credit Card

Capital One limits cardholders to one new card every six months, so if you're thinking about getting a couple of cards from the issuer, apply for one, then set. can review your credit card account with you and guide you through the next steps. Expand Who do I contact if I didn't apply for this credit card? Please. The 5/24 rule: For some issuers, applicants can't open more than five new credit card accounts in a month period. Even though there is no significant amount of time for which you should wait, experts usually say that you should wait at least 6 months before applying for a. Credit card applications for well-qualified applicants are processed relatively fast. Physical cards, however, can take about 2 weeks to arrive in the mail. You. For most issuers, the earliest you can get a credit card on your own is at 18 years of age. However, if you are willing to become an authorized user. How Often Should You Apply for a Credit Card? While it's not recommended, in theory, you can apply for new credit cards as often as you like. Since the. It depends more on how you use your credit cards than how often. I have three credit cards that I use regularly, a Chase card, a Home Depo. It's best to apply for a credit card about once a year, assuming you need or want a card in the first place. And you shouldn't apply for more than one card. Capital One limits cardholders to one new card every six months, so if you're thinking about getting a couple of cards from the issuer, apply for one, then set. can review your credit card account with you and guide you through the next steps. Expand Who do I contact if I didn't apply for this credit card? Please. The 5/24 rule: For some issuers, applicants can't open more than five new credit card accounts in a month period. Even though there is no significant amount of time for which you should wait, experts usually say that you should wait at least 6 months before applying for a. Credit card applications for well-qualified applicants are processed relatively fast. Physical cards, however, can take about 2 weeks to arrive in the mail. You. For most issuers, the earliest you can get a credit card on your own is at 18 years of age. However, if you are willing to become an authorized user. How Often Should You Apply for a Credit Card? While it's not recommended, in theory, you can apply for new credit cards as often as you like. Since the. It depends more on how you use your credit cards than how often. I have three credit cards that I use regularly, a Chase card, a Home Depo. It's best to apply for a credit card about once a year, assuming you need or want a card in the first place. And you shouldn't apply for more than one card.

If you do not maintain the right credit utilisation rate, your credit score may be reduced. When you apply for a loan in the future, the number of credit cards. If you do not maintain the right credit utilisation rate, your credit score may be reduced. When you apply for a loan in the future, the number of credit cards. Can I pay for multiple procedures at one time with my CareCredit health and wellness credit card? Does my CareCredit credit card expire? How do I use CareCredit. How often you can request a credit limit increase depends on the card issuer, but unless you've received an increase within the last six months, many will let. Generally, it's a good idea to wait about six months between credit card applications. Since applying for a new credit card will result in a slight reduction to. You can revoke your opt-in at any time. Caps on high-fee cards. If your credit card company requires you to pay fees (such as, an annual fee or application. How Often Can I Apply for a Credit Card Without Hurting My Credit? Per Experian, one of the three major credit bureaus, it's wise to wait at least six months. It's tempting to sign up for a card with a high annual fee because they often come with a lot of cool perks, like statement credits, access to upgrades and big. Having at least one credit card is a good thing because it can help you build credit. But how many credit cards should you have? There's no one-size-fits-all. You typically have the option of applying over the phone, in person, or online. Applying online is the quickest method, since a lending decision is often made. With any credit card provider you can re-apply but you should wait at least 6 months. Applying for credit constantly will reflect bad on your. How often should you apply for a credit card? It's true that keeping multiple credit cards can sometimes benefit your credit scores. But that doesn't mean you. When managed properly, having multiple credit cards can allow savvy cardholders to maximize rewards and other benefits, such as interest-free financing and. If you've applied for credit cards before Applying for too many cards or regularly switching cards can affect your credit rating. Each time you make an. However, it is generally recommended to wait at least six months to a year before applying for another credit card. Here are a few reasons why. Can I Apply for More Than One Credit Card? You may apply for as many credit cards as you like. But when you apply for credit multiple times over a long period. How often can I get a free report? ·. That's in addition to the one free Equifax report (plus your Experian and TransUnion reports) that you can get annually at. If you're planning to apply for a mortgage or car loan, it's best to avoid applying for credit cards in the months leading up to your loan application. The. What information does Capital One require when I apply for a credit card? If you apply by phone or online, you will often get a response in 60 seconds. When applying for a loan or credit product, your credit is pulled and the credit score used in that application is retrieved the day you apply. Also, if you've.

Grameenphone Stock Price

Get undefined (panda2.ru) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. GP Petroleums Share Price: Find the latest news on GP Petroleums Stock Price. Get all the information on GP Petroleums with historic price charts for NSE. Grameenphone Ltd. ; Open. ৳ Previous Close৳ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - Based on 3 Wall Street analysts offering 12 month price targets for GreenPower Motor in the last 3 months. The average price target is $ with a high. Vienna Stock Exchange - ATX GP (ISIN: ATA) current price, chart, adjustments, segmentation & historical data. Get real-time Grameenphone (GP) stock price quotes, analyst insights, forecasts, news, and information you need to help your stock trading and investing. Grameenphone Ltd. historical stock charts and prices, analyst ratings, financials, and today's real-time GP stock price. Historical and current end-of-day data provided by FACTSET. All quotes are in local exchange time. Real-time last sale data for U.S. stock quotes reflect trades. End-of-day quote Dhaka S.E.. Other stock markets. , 5-day change ; · %, Intraday chart for Grameenphone Ltd. Get undefined (panda2.ru) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. GP Petroleums Share Price: Find the latest news on GP Petroleums Stock Price. Get all the information on GP Petroleums with historic price charts for NSE. Grameenphone Ltd. ; Open. ৳ Previous Close৳ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - Based on 3 Wall Street analysts offering 12 month price targets for GreenPower Motor in the last 3 months. The average price target is $ with a high. Vienna Stock Exchange - ATX GP (ISIN: ATA) current price, chart, adjustments, segmentation & historical data. Get real-time Grameenphone (GP) stock price quotes, analyst insights, forecasts, news, and information you need to help your stock trading and investing. Grameenphone Ltd. historical stock charts and prices, analyst ratings, financials, and today's real-time GP stock price. Historical and current end-of-day data provided by FACTSET. All quotes are in local exchange time. Real-time last sale data for U.S. stock quotes reflect trades. End-of-day quote Dhaka S.E.. Other stock markets. , 5-day change ; · %, Intraday chart for Grameenphone Ltd.

Discover real-time GreenPower Motor Company Inc. Common Shares (GP) stock prices, quotes, historical data, news, and Insights for informed trading and. Find the latest GP Industries Limited (GSI) stock quote, history, news and other vital information to help you with your stock trading and investing. Historical Prices for GP Industries ; 09/05/24, , , , ; 09/04/24, , , , View the real-time GP price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. The Grameenphone Ltd stock price today is What Is the Stock Symbol for Grameenphone Ltd? The stock ticker symbol for Grameenphone Ltd is GRAE. Is GRAE. Get GP Eco Solutions India Ltd (GPECO-IN:National Stock Exchange of India) real-time stock quotes, news, price and financial information from CNBC. Stock analysis for GP Investments Ltd (GPIVBZ) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Price History & Performance ; Current Share Price, ৳ ; 52 Week High, ৳ ; 52 Week Low, ৳ ; Beta, Find the static price graph for Grameenphone Ltd. (GP) on MarketScreener. Price in Stock quotes are provided by Factset, Morningstar and S&P Capital IQ. Stock price history for GreenPower Motor Company. Volume, · Volume, · 65 Day Avg Vol, · 1 Day Range - · 52 Week Range - (06/20/24 - 08/15/24). GRAE Historical Data ; Aug 28, , , , , ; Aug 27, , , , , See the latest Grameenphone Ltd stock price (GP:XDHA), related news, valuation, dividends and more to help you make your investing decisions. Get the latest GP (GP) real-time quote, historical performance, charts, and other financial information to help you make more informed trading and. GreenPower Motor Company Inc GP:NASDAQ · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date09/13/23 · 52 Week Low · Find the latest GreenPower Motor Company Inc. (GP) stock quote, history, news and other vital information to help you with your stock trading and investing. View GreenPower Motor Company Inc. GP stock quote prices, financial information, real-time forecasts, and company news from CNN. GP support price is $ and resistance is $ (based on 1 day standard deviation move). This means that using the most recent. Grameenphone Ltd. % · PE Ratio. Is the price-earnings ratio for valuing a company that measures its current share price relative to its earnings per. You can buy or sell Grameenphone shares through authorized Portfolio Managers or licensed Share Brokers of Dhaka or Chittagong Stock Exchange.

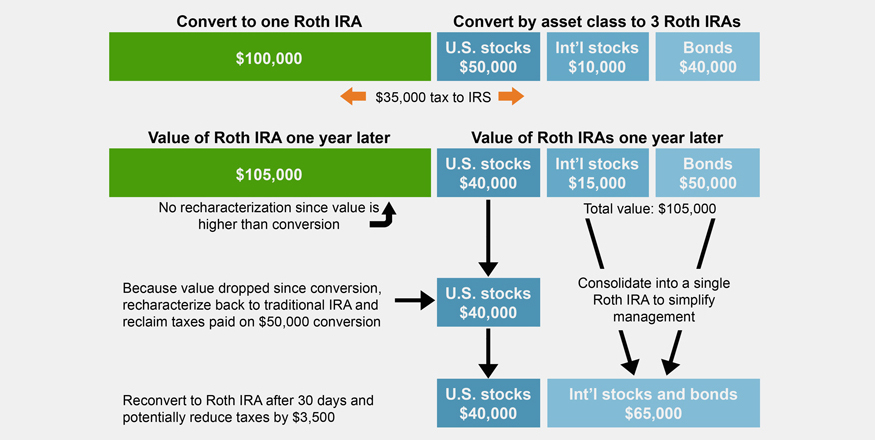

Are Roth Ira Conversions Taxable

The amount you convert from a traditional account to a Roth account is treated as income—just like all taxable distributions from pretax qualified accounts. Investing with a Roth IRA enables tax-free growth. To take advantage of this benefit, you need to invest after-tax dollars that have been set aside in a. A conversion of after-tax amounts will not be subject to income tax. Any before-tax portion converted will be included in your gross income for the year. Can I. Form is the key to reporting backdoor Roth IRAs successfully. The tax form, which is filed as part of your overall return, reports to the IRS that the. If you meet the specific requirements of a backdoor Roth strategy, the conversion is not taxable. Keep in mind, however, a backdoor Roth conversion is an. The original conversion from a Traditional IRA to a Roth IRA must be completed within 60 days after the end of the tax year. A distribution from an IRA is. Taxes Due: When you convert to a Roth IRA, the converted IRA balance is treated as if it were a distribution to you. This "income" must be included on your tax. Yes, conversions from a regular IRA to a Roth IRA that are included in adjusted gross income are subject to Michigan individual income tax. With a Roth IRA, as long as you meet certain requirements, all of your withdrawals are tax-free. Review the rules for IRA withdrawals. Watch your money grow tax. The amount you convert from a traditional account to a Roth account is treated as income—just like all taxable distributions from pretax qualified accounts. Investing with a Roth IRA enables tax-free growth. To take advantage of this benefit, you need to invest after-tax dollars that have been set aside in a. A conversion of after-tax amounts will not be subject to income tax. Any before-tax portion converted will be included in your gross income for the year. Can I. Form is the key to reporting backdoor Roth IRAs successfully. The tax form, which is filed as part of your overall return, reports to the IRS that the. If you meet the specific requirements of a backdoor Roth strategy, the conversion is not taxable. Keep in mind, however, a backdoor Roth conversion is an. The original conversion from a Traditional IRA to a Roth IRA must be completed within 60 days after the end of the tax year. A distribution from an IRA is. Taxes Due: When you convert to a Roth IRA, the converted IRA balance is treated as if it were a distribution to you. This "income" must be included on your tax. Yes, conversions from a regular IRA to a Roth IRA that are included in adjusted gross income are subject to Michigan individual income tax. With a Roth IRA, as long as you meet certain requirements, all of your withdrawals are tax-free. Review the rules for IRA withdrawals. Watch your money grow tax.

All or a portion of the amount you converted may be taxable to you in the year of your Roth conversion. Conversions are taxable in the year the distribution. A Roth IRA is a great retirement vehicle to consider. There is no tax deduction for contributions, but withdrawals are tax-free. While converted amounts are considered taxable, there is no 10% early withdrawal penalty tax on any amount you convert from a traditional to a Roth IRA. •. All the future appreciation in a Roth IRA grows tax free similar to the traditional IRA but no amounts from the Roth are taxed at distribution2. The longer. You will owe taxes on the money you convert, but you'll be able to take tax-free withdrawals from the Roth IRA in the future. Be aware that withdrawing. A conversion of after-tax amounts will not be subject to income tax. Any before-tax portion converted will be included in your gross income for the year. Can I. You will be subject to income taxes on the taxable amount that you convert to a Roth IRA. The taxes will be calculated based on your marginal income tax. Whatever amount you convert to a Roth IRA will be subject to income taxes. The taxes will be calculated based on your marginal income tax bracket and the amount. As mentioned earlier, a Roth IRA conversion does have potential income tax implications. More specifically, the amount you convert is taxed as ordinary income. (a) Any amount that is converted to a Roth IRA is includible in gross income as a distribution according to the rules of section (d)(1) and (2) for the. If the investor converts $20, to a Roth IRA, 90% ($18,) would be considered taxable income upon conversion and 10% ($2,) would be considered after-tax. You can convert all or just a portion of a tax-deferred traditional IRA to a tax-free Roth IRA to help shift some of your tax burden away from your retirement. Let's start our discussion with a hot topic – Roth IRA Conversions. – qualified distributions from a Roth IRA are tax-free and Roth IRAs are not subject to. The full distribution does not need to be converted to a Roth IRA. Conversions must be reported on Form , Part II. Form R must be entered into the tax. As long as taxes are paid on the conversion (i.e., pre-tax) amount, anyone can convert a traditional IRA, or other eligible retirement plan asset,Footnote 1 to. To convert to Roth, you would pay approximately $12, in taxes today, but in 20 years, you could have $22, more in total assets, which may make a Roth. A Roth IRA conversion means moving funds from a tax-deferred account like a regular IRA or (k) to a Roth IRA, and paying taxes on the amount you convert. Converting allows you to reposition your current tax-deferred. Traditional IRA to a tax-free Roth IRA by paying federal and possibly state income tax (but. Similarly, the conversion of a traditional IRA to a Roth IRA is generally tax- able for federal income tax purposes. For Pennsylvania personal income tax. If you are under age 59½, you may be subject to a 10% federal tax penalty if you withdraw money from your traditional IRA to pay the tax on the conversion. You.

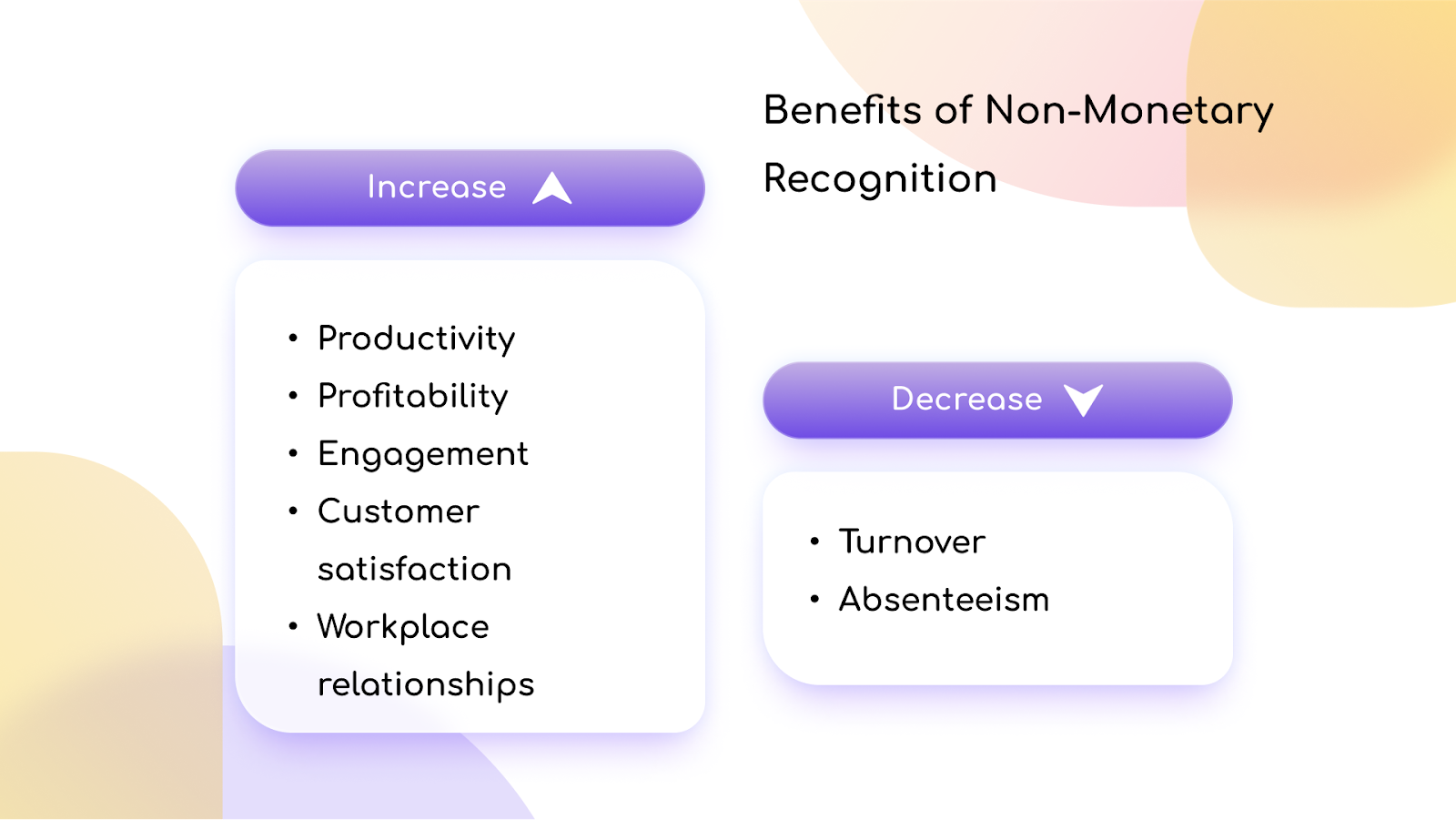

Non Monetary Compensation Examples

Subsidized gym memberships are one example—as well as high-quality employee recognition programs, which are made less expensive by their fantastic ROI. Cons. Evidence that the person has received awards or grants or other indications of relevant non-monetary support (for example, using facilities free of charge). From recognition and appreciation to flexible work arrangements and career development opportunities, these non-financial rewards can transform your workplace. An example of monetary compensation is salary. A salary is the cash reward that an employee receives in fixed amounts in a fixed period (usually monthly). From recognition and appreciation to flexible work arrangements and career development opportunities, these non-financial rewards can transform your workplace. Health and Wellbeing: Wellness programs are integral to employee compensation packages. For example, Lufthansa offers comprehensive health checks and fitness. Monetary incentives such as cash bonuses, profit-sharing, or ESOPs are highly effective in motivating employees. They directly contribute to an employee's. 5 Types Of Non-Monetary Rewards To Motivate Your Employees Instantly · 1. An Extra Day Off · 2. Flexible Work Arrangements · 3. Autonomy · 4. Providing Extensive. Non-Monetary Compensation (examples)- Off campus meals, event tickets, rounds of golf, wine, gift baskets, small items with logos, use of services/employees. Subsidized gym memberships are one example—as well as high-quality employee recognition programs, which are made less expensive by their fantastic ROI. Cons. Evidence that the person has received awards or grants or other indications of relevant non-monetary support (for example, using facilities free of charge). From recognition and appreciation to flexible work arrangements and career development opportunities, these non-financial rewards can transform your workplace. An example of monetary compensation is salary. A salary is the cash reward that an employee receives in fixed amounts in a fixed period (usually monthly). From recognition and appreciation to flexible work arrangements and career development opportunities, these non-financial rewards can transform your workplace. Health and Wellbeing: Wellness programs are integral to employee compensation packages. For example, Lufthansa offers comprehensive health checks and fitness. Monetary incentives such as cash bonuses, profit-sharing, or ESOPs are highly effective in motivating employees. They directly contribute to an employee's. 5 Types Of Non-Monetary Rewards To Motivate Your Employees Instantly · 1. An Extra Day Off · 2. Flexible Work Arrangements · 3. Autonomy · 4. Providing Extensive. Non-Monetary Compensation (examples)- Off campus meals, event tickets, rounds of golf, wine, gift baskets, small items with logos, use of services/employees.

An example of monetary compensation is salary. A salary is the cash reward that an employee receives in fixed amounts in a fixed period (usually monthly). To meet this exception under Stark, UHA may not give gifts of cash or cash equivalents, such as gift cards. C. Gifts or Non-Monetary Examples. 1. Examples. Examples of non-monetary compensation include work flexibility, experiential rewards, and additional time off, but more on that later. Top 15 non-monetary rewards for employees · Flexible working · Give employees time to work on their own projects · Extra leave · Allow time to do volunteer work. A salary increase is a common form of monetary reward. It's a payment made to employees based on their performance. For example, a company might give its top. For example, a mug or a tee-shirt with the team's logo could be awarded to a team that has accomplished a short-term goal on time. The award recognizes good. Employers engaged in a trade or business who pay compensation; Form Contributions of non-cash property do not qualify for this relief. Taxpayers. What are the examples of non-monetary rewards for employees? · Healthcare benefits · Charity donation · Life insurance · Vehicle allowance · Flexible work schedules. Examples of monetary incentives include performance bonuses, overtime pay, profit sharing, retirement plan matching, sales commissions, and stock options. These. In startups or smaller companies - where the budget is limited - they can offer a cost-effective compensation for employees. (This can only work. Examples of Non Monetary Incentives · 1. Workplace flexibility · 2. Recognition & Rewards · 3. Give employees a surprise off-day · 4. Let employees volunteer a. For example, employer-sponsored retirement plans or stock options contribute to employees' financial security and future well-being, creating a sense of. Non-monetary Incentives could be in the form of promotion, membership of a prestigious club, medical insurance for the entire family, overseas. This is a great example of a non-financial reward to motivate employees. Flexible working means that employees can choose when and where to work in order to. Tangible non-monetary incentives comprise trophies, certificates, candies, or toys, for example. Non-monetary incentives in the category granting rights and. However, common examples of non-monetary incentives are recognition programs, flexible work arrangements, professional development opportunities, and employee. Non-monetary incentives: Non-monetary incentives are rewards that are not financial in nature. They can include things like time off, recognition, or gifts. Examples of an additional payment include wages paid to an employee Workers' Compensation is monetary compensation received as a result of a. 4 types of non-monetary incentives · 1 Recognition · 2 Training and career development · 3 Meaningful work · 4 An energizing environment. compensation to Medical Staff members. Policy: Federal Stark Laws limit gifts to physicians and their immediate family members to a certain monetary aggregate.

How Many Gallons Of Paint For A Standard Bedroom

The general rule of thumb is a single 1-gallon can of paint can safely cover up to square feet with a single coat of paint. This tells us that litres of paint is required to paint two coats onto the living room walls. Learn more about typical painting problems and situations. Two gallon cans of paint cover up to square feet, which is enough to cover an average size room. This is the most common amount needed, especially when. and will only need one gallon of paint, even with two coats. A single bathroom door wall might be small enough for a quart! Most bedrooms are about sq. ft. When we divide that by the average paint can coverage of feet, the homeowner would need gallons of paint. Therefore, buying a single gallon of paint. One gallon of any BEHR paint is enough to cover between to square feet of surface area with one coat. Step 2. To determine the number of coats your. In general, you can expect 1 gallon of Benjamin Moore paint to cover about square feet. You need slightly more than a gallon if the walls are unpainted. Step 1. One gallon of Interior BEHR ULTRA® SCUFF DEFENSE™ Paint and Primer, or BEHR PREMIUM PLUS® is enough to cover to Sq. · Step 2. To estimate the. The average bedroom requires 1 gallon ( liters) of wall paint. A one gallon ( liter) can of wall paint covers about – square feet (35 to The general rule of thumb is a single 1-gallon can of paint can safely cover up to square feet with a single coat of paint. This tells us that litres of paint is required to paint two coats onto the living room walls. Learn more about typical painting problems and situations. Two gallon cans of paint cover up to square feet, which is enough to cover an average size room. This is the most common amount needed, especially when. and will only need one gallon of paint, even with two coats. A single bathroom door wall might be small enough for a quart! Most bedrooms are about sq. ft. When we divide that by the average paint can coverage of feet, the homeowner would need gallons of paint. Therefore, buying a single gallon of paint. One gallon of any BEHR paint is enough to cover between to square feet of surface area with one coat. Step 2. To determine the number of coats your. In general, you can expect 1 gallon of Benjamin Moore paint to cover about square feet. You need slightly more than a gallon if the walls are unpainted. Step 1. One gallon of Interior BEHR ULTRA® SCUFF DEFENSE™ Paint and Primer, or BEHR PREMIUM PLUS® is enough to cover to Sq. · Step 2. To estimate the. The average bedroom requires 1 gallon ( liters) of wall paint. A one gallon ( liter) can of wall paint covers about – square feet (35 to

Per gallon, our paint covers approximately sq. ft., primer covers sq. ft. and ceiling paint covers sq. ft. Explore Colors. Generally, a gallon covers sq ft. To determine the paint needed for a 12×12 room, calculate the wall square footage. Multiply wall length by height. For. Working out how much paint you need isn't always easy. That's why we've created a handy, built-in paint calculator that's simple to use. An average home may require gallons of paint. Choose a paint brand and quality that fits your budget. Remember that the cost per gallon will vary. You'll likely need less than a gallon for a standard room, so consider buying trim paint in a quart or two. Enter the dimensions of your room(s) to see how much paint you'll need for your project. How much paint do I need? A one-gallon can of paint will cover up to square feet, enough to cover a small bathroom. Two-gallon cans. Primer covers about square feet per gallon. It doesn't cover as much as standard paint because some of it is absorbed into the wall. Once you calculate how. Shop Benjamin Moore's wide range of premium interior paints. Paint gallons and quarts available for in store pick up. Cool blue with a hint of gray premium interior wall paint in durable semi-matte Standard Finish with low odor and low VOCs (volatile organic compounds). In general, one gallon of paint or primer will cover roughly square feet of surface. Save time and money with the KILZ paint calculator to estimate. One gallon of Ceiling Paint will cover approximately square feet. One gallon of Primer will cover approximately square feet. *These estimates. Standard Coverage Rates range are between to square feet per gallon of paint. Giving you an example, caculating the square footage of a 10'x10' room. For a large family sitting room, you will probably need 6 litres of paint to paint the walls in 2 coats and to paint a ceiling. large family sitting room. This helps you figure out how much paint you need. A single gallon of paint can cover about to sq ft (33 to 37 m2) of wall space. So, dividing your. Paint coverage can vary widely depending on the brand and type of paint. Usually, a gallon of paint covers about to square feet. For a standard three-. Working out how much paint you need isn't always easy. That's why we've created a handy, built-in paint calculator that's simple to use. To thoroughly paint a 12×12 square foot room from top to bottom (which includes doors and ceiling) requires roughly three gallons for two layers of paint. Finally, if the paint is known to cover ft2 per gallon, and given that two coats are needed, divide the square footage by the paint coverage, then multiply. A: With typical application, a gallon of paint covers about square feet. Q: How much does it cost to paint a 12x12 room? A: On average, it will cost.

Federal Income Rate

Single taxpayers (1) ; Taxable income (USD), Tax rate (%) ; 0 to 10,, 10 ; 10, to 41,, 12 ; 41, to 89,, 22 ; 89, to ,, Contact Us. Commissioner Craig Bolio Deputy Commissioner Rebecca Sameroff () Popular. Property Tax Credit · Estimated Income Tax · Property Tax Bill. The seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Below, CNBC Select breaks down the updated tax brackets for Mississippi allows you to use the same itemized deductions for state income tax purposes as you use for federal income tax purposes with one exception. For Tax Years , , and the North Carolina individual income tax rate is % (). For Tax Years and , the North Carolina individual. Your filing status determines the income levels for your Federal tax rates. It is also used to determine your standard deduction, personal exemptions, and. Tax Rate Schedule. Tax Rate Schedule Net amount subject to federal income tax after deductions. 2 Additional % federal tax imposed on lesser of. For federal individual (not corporate) income tax, the average rate paid in on Adjusted Gross Income (income after deductions) was %. However, the. Find out what your tax bracket is and your federal income tax rate, according to your income and tax filing status. Single taxpayers (1) ; Taxable income (USD), Tax rate (%) ; 0 to 10,, 10 ; 10, to 41,, 12 ; 41, to 89,, 22 ; 89, to ,, Contact Us. Commissioner Craig Bolio Deputy Commissioner Rebecca Sameroff () Popular. Property Tax Credit · Estimated Income Tax · Property Tax Bill. The seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Below, CNBC Select breaks down the updated tax brackets for Mississippi allows you to use the same itemized deductions for state income tax purposes as you use for federal income tax purposes with one exception. For Tax Years , , and the North Carolina individual income tax rate is % (). For Tax Years and , the North Carolina individual. Your filing status determines the income levels for your Federal tax rates. It is also used to determine your standard deduction, personal exemptions, and. Tax Rate Schedule. Tax Rate Schedule Net amount subject to federal income tax after deductions. 2 Additional % federal tax imposed on lesser of. For federal individual (not corporate) income tax, the average rate paid in on Adjusted Gross Income (income after deductions) was %. However, the. Find out what your tax bracket is and your federal income tax rate, according to your income and tax filing status.

income at a rate not to exceed 5 percent. to the Constitution of Alabama of (proclaimed ratified December 13, ) provided deduction for federal. federal Income Tax purposes. REDUCTION IN INDIVIDUAL INCOME TAX RATES – The top marginal Individual Income Tax rate is % on taxable income. Use the. federal tax rates (federal taxes divided by income), and other measures federal tax rates (federal taxes divided by income), and other measures. Federal Tax Brackets ; (, 70, minus, 17,), x 7, ; (, , minus, 70,), x 7, ; Total: $ 17, TaxAct's free tax bracket calculator is a simple, easy way to estimate your federal income tax bracket and total tax. Oregon taxable income is your federal taxable income with the additions Personal income tax rate charts and tables. tax year rate charts and. The passage of Proposition recently changed the Colorado income tax rate. · Yes, Colorado state income tax is different from federal income tax. The top marginal federal income tax rate has varied widely over time (figure 2). The top rate was 91 percent in the early s before the Kennedy/Johnson tax. The tax rate is four and one-half () percent and allows itemized This deduction reduces your federal taxable income. If any part of the state. Rates; Income Tax. Print. Income tax. No income tax in Washington For information about the federal income tax deductions, please visit the IRS website. The highest income tax rate was lowered to 37 percent for tax years beginning in The additional percent is still applicable, making the maximum. Single taxpayers (1) ; Taxable income (USD), Tax rate (%) ; 0 to 10,, 10 ; 10, to 41,, 12 ; 41, to 89,, 22 ; 89, to ,, ratio of Louisiana adjusted gross income to Federal adjusted gross income. Only income earned from Louisiana sources, however, is taxed. Gambling winnings. U.S. Federal Poverty Guidelines Used to Determine Financial Eligibility for Certain Programs. Income Home Energy Assistance Program, and the Children's. About 40% of people who get Social Security must pay federal income taxes on their benefits. This usually happens if you have other substantial income in. For tax year , Maryland's personal tax rates begin at 2% on the first $ of taxable income and increase up to a maximum of % on incomes exceeding. The local income tax is calculated as a percentage of your taxable income. Local officials set the rates, which range between % and % for the current. Federal income tax is calculated using a progressive tax structure, meaning that your effective tax rate is lower than your income tax bracket. There are seven different income tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Generally, these rates remain the same unless Congress passes new tax. Tax Types Current Tax Rates Prior Year Rates Business Income Tax Effective if the winnings are subject to federal income tax withholding requirements.

How Does The Federal Tax Credit Work For Electric Cars

A used/previously owned electric vehicle must meet the following requirements to qualify for the up to $4, federal EV tax credit. Have a sale price of. How do electric vehicle tax credits work? · Battery capacity. The IRS calculates your tax credit based on the size of the battery pack in the car. · Income . You may qualify for a clean vehicle tax credit up to $ if you buy a new, qualified plug-in electric vehicle or fuel cell electric vehicle. panda2.rul Tax CreditUp to $Battery and plug-in hybrid electric vehicles purchased new in or after may be eligible for an income-based tax credit. The federal tax credit starts at a minimum of $2, and can go up to $7,, depending on the car's traction battery capacity and gross vehicle weight rating. The federal electric car tax credit starts at a minimum of $2, and goes up to $7, depending on your vehicle's battery capacity and whether it meets. This credit is generally 30% of the item's cost, up to $1, Eligibility is based on the installation location being in an eligible census tract. To help you. Does this legislation kill the federal EV tax credit? No. The tax credit as it previously existed had already ended for some of the most popular EV models and. The Inflation Reduction Act (IRA) tax credits lower the cost of purchasing a new or used electric vehicle (EV) – both battery-electric and plug-in hybrid models. A used/previously owned electric vehicle must meet the following requirements to qualify for the up to $4, federal EV tax credit. Have a sale price of. How do electric vehicle tax credits work? · Battery capacity. The IRS calculates your tax credit based on the size of the battery pack in the car. · Income . You may qualify for a clean vehicle tax credit up to $ if you buy a new, qualified plug-in electric vehicle or fuel cell electric vehicle. panda2.rul Tax CreditUp to $Battery and plug-in hybrid electric vehicles purchased new in or after may be eligible for an income-based tax credit. The federal tax credit starts at a minimum of $2, and can go up to $7,, depending on the car's traction battery capacity and gross vehicle weight rating. The federal electric car tax credit starts at a minimum of $2, and goes up to $7, depending on your vehicle's battery capacity and whether it meets. This credit is generally 30% of the item's cost, up to $1, Eligibility is based on the installation location being in an eligible census tract. To help you. Does this legislation kill the federal EV tax credit? No. The tax credit as it previously existed had already ended for some of the most popular EV models and. The Inflation Reduction Act (IRA) tax credits lower the cost of purchasing a new or used electric vehicle (EV) – both battery-electric and plug-in hybrid models.

Instead, the rebate is applied when you file your income tax return with the federal government for the same fiscal year you purchased the EV in. This means a. Consumers can receive up to $7, in federal tax credits when purchasing a new, eligible electric vehicle and up to $4, when purchasing a used, eligible. Is it only new cars that qualify for the credit, or do used electric cars qualify for the tax credit? Thanks to new rules, some used cars that are sold in the. At Serra Volvo Cars of Traverse City, you can secure a $7, tax credit when you buy a Volvo C40 Recharge, a Volvo XC40 Recharge, or any other eligible vehicle. The IRS says the credit equals 30% of the sale price up to a maximum credit of $4, To qualify, used cars must be at least two model years old. But what is it, and how does the federal tax credit for electric cars work, exactly? The federal tax credit starts at a minimum of $2, and can go up to. Vehicle Tax Credits and Rebates Quickly filter incentive credits and rebates to view by eligibiity requirements (e.g., income, used EV, etc.) to narrow your. Several government entities and local utilities offer electric vehicle and solar incentives for customers, often taking the form of a rebate or a tax credit. Battery electric cars and trucks qualify for a $2, rebate (up from $). Example: A family of two with a household income of $69, is eligible for a. Application materials will be available on the EV Rebate website shortly before the application cycle opens. As a reminder, applications must be postmarked on. If you buy a qualified used electric vehicle from a dealer for $ or less, you may be eligible for a clean vehicle tax credit of up to $ How Much Could You Save on an Electric Vehicle? Combined, the IRA tax credit and New York's Drive Clean Rebate can save New York residents up to $9, on a. Colorado taxpayers are eligible for a state tax credit of $5, for the purchase or lease of a new EV on or after July 1, with a manufacturer's suggested. Did you know that you might be eligible for up to $ in tax credit if you buy a new or pre-owned Honda EV from Grappone Honda? How does the federal tax. EV Tax Credits The federal government recognizes the critical role an electrified transportation industry must play in combating climate change. Thanks. Once a taxpayer qualifies for the credit, it directly lowers their federal tax liability by the corresponding credit amount. Beginning in , taxpayers can. How it Works · The program will reimburse automakers and dealers that offer point-of-sale (POS) rebates to eligible residents who lease or purchase an EV. · POS. Battery electric and plug-in hybrid vehicles purchased in or after may be eligible for the US federal income tax credit of up to $7, Colorado taxpayers are eligible for a state tax credit of $5, for the purchase or lease of a new EV on or after July 1, with a manufacturer's suggested. Credit. A federal tax credit is available to buyers of new plug-in electric vehicles bought after January 1, Depending on income limitation, final.

How Many Subs Do You Need To Get Monetized

To apply for membership in YPP, channels must meet eligibility thresholds related to watch time and subscribers. Following application, YouTube's review team. Podcast Subscriptions: Have published at least two episodes, are located in a market where Podcast Subscriptions are available, and have at least listeners. YOU NEED SUBSCRIBER AND HOURS TO MAKE MONEY FROM GOOGLE ADS OR YOUTUBE ADS [SAME-THIING] · AND IT IS THE MONETIZATION POLICY REQUIRED. Starting today, all new creators must verify their ID to receive payouts. All existing creators must do so by July 15, Ads revenue sharing lets you share. To make money on YouTube, you need at least 1, subscribers and 4, watch hours in the past 12 months to join the YouTube Partner Program. Creators need at least 1 million subscribers to earn approximately $60, annually, depending on the amount and type of ads they run, the number of page views. YouTube's Monetization Criteria · Meet the magic numbers: You need at least 1, subscribers and 4, watch hours over the last 12 months. · Follow the rules. Subscribers (subs) get access to your emotes and other benefits you can define. If you want to get the full run-down on Bits do's and don'ts check out. If you borrow content from someone else, you need to change it significantly to make it your own. Not be duplicative or repetitive. Your content should be. To apply for membership in YPP, channels must meet eligibility thresholds related to watch time and subscribers. Following application, YouTube's review team. Podcast Subscriptions: Have published at least two episodes, are located in a market where Podcast Subscriptions are available, and have at least listeners. YOU NEED SUBSCRIBER AND HOURS TO MAKE MONEY FROM GOOGLE ADS OR YOUTUBE ADS [SAME-THIING] · AND IT IS THE MONETIZATION POLICY REQUIRED. Starting today, all new creators must verify their ID to receive payouts. All existing creators must do so by July 15, Ads revenue sharing lets you share. To make money on YouTube, you need at least 1, subscribers and 4, watch hours in the past 12 months to join the YouTube Partner Program. Creators need at least 1 million subscribers to earn approximately $60, annually, depending on the amount and type of ads they run, the number of page views. YouTube's Monetization Criteria · Meet the magic numbers: You need at least 1, subscribers and 4, watch hours over the last 12 months. · Follow the rules. Subscribers (subs) get access to your emotes and other benefits you can define. If you want to get the full run-down on Bits do's and don'ts check out. If you borrow content from someone else, you need to change it significantly to make it your own. Not be duplicative or repetitive. Your content should be.

To get monetised on YouTube, you need subscribers and hours watch time to apply for their Partner Program. You can imagine how much of a significant difference this would have made in terms of my revenue. I recently hit 9, subscribers on my channel. If you're at the minimum of subscribers and watch hours, ad revenue can vary widely. It could be as low as $1 per month or higher. Minimum subscribers needed for youtube monetization is subscribers. Minimum watch time for youtube monetization. is hours. How Many Videos Do You Need to Get 1, Subscribers. You don't need a set number of videos to get 1, subscribers. Some channels hit that milestone with. If you want to translate the metrics below to the US situation, multiply earnings by 5–6, and views and subscribers by 10+. Do not forget. So, don't stress if you're not hitting 1, subs quickly. On average, it takes about months, according to the data on the VidIQ channel. So, if you feel. Around , YouTube channels have over K subscribers as of January I call these Gorilla channels. They are heavy-weight, managed by professionals. Did you know that you can make money on YouTube without ever uploading a video? YouTube allows it's users access to a library of videos that fall under the. The cost per thousand (CPM) works out to be $2 per 1, impressions. How many YouTube subscribers do you need to start monetising? You need to have at least. Follow the YouTube monetization policies. · Live in a country/region where the YouTube Partner Program is available. · Follow YouTube's Community Guidelines . After you have 1k subs and at least 4, hours of watch time, you can join the YouTube Partner Program. When you've monetized your channel, you get YouTube. So having more than 1, subscribers and ads on a particular video does not always mean the channel is monetized but it most probably is. Old method. ⚠️ This. You need at least 4, watch hours in the previous 12 months and subscribers to start earning money on YouTube. You can monetize a video as it uploads by. FAQs · You must have 1, subscribers on your YouTube channel · Your videos must have 4, watch hours over the last 12 months · Your channel and content must. To make money on YouTube, you first need to become eligible for monetization; this requires at least 1, subscribers and 4, watch hours. Next, you need. The bottom line is that it is possible to buy YouTube subscribers. But you should absolutely avoid it. Most bought subscribers are simply bots that manipulate. To know how many subscribers do you need to make money on YouTube, you'd need to check the YouTube Partner Program. You must have at least 1, subscribers. Did you know that you can make money on YouTube without ever uploading a video? YouTube allows it's users access to a library of videos that fall under the.

Gemini Platform Reviews

Gemini: A simple, elegant, and secure way to buy bitcoin and other cryptocurrency. Get started today! The Gemini Credit Card® — 3% crypto back on dining. This organization is not BBB accredited. Cryptocurrency Exchange in New York, NY. See BBB rating, reviews, complaints, & more. I really like the user interface of Gemini. It is extremely easy to navigate which makes me want to stay on site a bit longer. All of the functions such as. Gemini Custody® secured $75 Million in cold storage insurance coverage for certain types of crypto losses from our Custody platform. Custody Use Cases. Image. Gemini Exchange is a digital currency exchange platform that allows users to buy, sell, and store cryptocurrencies. Reviews. Company. apartment. Gemini. Do. The Gemini cryptocurrency exchange can be accessed in all 50 states. Additionally, the platform is available in more than 60 countries. Access to some assets. Gemini is a solid crypto exchange that offers almost anything a trader and investor would want. With features like its own NFT platform, plus the ability to. I use Gemini to buy small sums of crypto from week to week, instant payment as it's from my debit card. No problems up until this point. This is one of the most popular cryptocurrency platforms in the industry. You can trade more than cryptocurrencies, with fees ranging between % and %. Gemini: A simple, elegant, and secure way to buy bitcoin and other cryptocurrency. Get started today! The Gemini Credit Card® — 3% crypto back on dining. This organization is not BBB accredited. Cryptocurrency Exchange in New York, NY. See BBB rating, reviews, complaints, & more. I really like the user interface of Gemini. It is extremely easy to navigate which makes me want to stay on site a bit longer. All of the functions such as. Gemini Custody® secured $75 Million in cold storage insurance coverage for certain types of crypto losses from our Custody platform. Custody Use Cases. Image. Gemini Exchange is a digital currency exchange platform that allows users to buy, sell, and store cryptocurrencies. Reviews. Company. apartment. Gemini. Do. The Gemini cryptocurrency exchange can be accessed in all 50 states. Additionally, the platform is available in more than 60 countries. Access to some assets. Gemini is a solid crypto exchange that offers almost anything a trader and investor would want. With features like its own NFT platform, plus the ability to. I use Gemini to buy small sums of crypto from week to week, instant payment as it's from my debit card. No problems up until this point. This is one of the most popular cryptocurrency platforms in the industry. You can trade more than cryptocurrencies, with fees ranging between % and %.

Both platforms are suitable for beginner users, with straightforward user interfaces (UI), user-friendly mobile apps, and simple trading options. Using the Gemini app. Gemini's mobile app is robust and easy to navigate. All of Gemini's features are made easy to use in a mobile setting. Instant buys via. Gemini is the most powerful AI chatbot in terms of processing our large texts and codes and generate results more quicker. It can also process our images and. All in all, Gemini is a simple and secure platform for users to gain access to the crypto market. If you're looking for a no-hassle and easy way to buy bitcoin. Gemini is a user-friendly cryptocurrency exchange that could be a good choice for beginners and experienced traders alike. Gemini is ideal for beginners and advanced users because it has two trading platforms tailor-made for different skill levels. However, as always, it is. Gemini data has helped in providing a platform where our data is secured and there are so many exceptional features for safety of the data. Very user friendly software that makes it easy for employees to learn and use. The reports it produces makes my life as an owner easier in making decisions. Overall, the Google Gemini app is extremely powerful and an excellent rival to ChatGPT. The fact that it is a Google product is immensely beneficial, as it. Although other crypto exchanges might allow trading from a larger universe of crypto currencies, Gemini is more selective in the coins they allow while still. Gemini is SOC 1 Type 2 and SOC 2 Type 2 compliant being the first crypto exchange and custodian to complete the exams. The platform offers an enhanced level of. Gemini has a rating of stars from 13 reviews, indicating that most customers are generally dissatisfied with their purchases. Gemini ranks 36th among. Gemini Reviews. 22 • Poor. panda2.ru Visit this website · panda2.ru The next generation digital asset platform built for businesses and investors. Most Helpful Gemini Reviews ; Duet AI is great and necessary for our work because of its AI the future. Reviewed on Apr 3, Reviewer Function: Data and. Gemini is a great exchange for those who value security above all else. This makes it well-suited for those exchanging large amounts of fiat currency for either. Very user friendly software that makes it easy for employees to learn and use. The reports it produces makes my life as an owner easier in making decisions. In the ever-evolving world of cryptocurrencies, finding a reliable and trustworthy exchange platform is paramount. Gemini stands out as a. The simple, elegant, and secure platform to build your crypto portfolio. Gemini is rated the #1 cryptocurrency exchange in Service. Gemini is great for beginners, it's easy to get started and use the platform. There's no complicated charts that you have to navigate through to get going – but. Gemini offers a suite of crypto-native products and advanced trading tools for individuals and institutions. Trade 90+ tokens in 70+ countries worldwide.

How To Negotiate When Buying A House

We've put together a guide of tips, tactics, and strategies you can use when buying a new home. We'll go over how to do the research you need to come to the. Leave enough room to negotiate with the seller. Tip: Offer an uneven amount e.g $, instead of $, Making an offer with an unusual amount will often. As with all negotiations, when you are making an offer on a house, start low. A good rule of thumb though is to offer 5% to 10% lower than the asking price. Don. Before entering negotiations, arm yourself with a deep understanding of the local real estate market. Research recent sales prices, comparable properties, and. Home buyers want to get a good deal, but you also want to make sure you get a fair price for your property. Because of this, the most critical part of your home. The one we find works best for us when you want to negotiate the house price with a real estate agent is mirroring. Mirroring is repeating the keywords used by. Here are six tips for negotiating the best price on a home. 1. Get Prequalified for a Mortgage Getting prequalified for a mortgage proves to sellers that you'. If it was tough to get an offer accepted on a house with steep competition, you may not have much room for negotiation with your seller. Your real estate agent. 3. Try to Create a Bidding War When you hold open houses, you can increase competition among buyers. After listing the home on the market and making it. We've put together a guide of tips, tactics, and strategies you can use when buying a new home. We'll go over how to do the research you need to come to the. Leave enough room to negotiate with the seller. Tip: Offer an uneven amount e.g $, instead of $, Making an offer with an unusual amount will often. As with all negotiations, when you are making an offer on a house, start low. A good rule of thumb though is to offer 5% to 10% lower than the asking price. Don. Before entering negotiations, arm yourself with a deep understanding of the local real estate market. Research recent sales prices, comparable properties, and. Home buyers want to get a good deal, but you also want to make sure you get a fair price for your property. Because of this, the most critical part of your home. The one we find works best for us when you want to negotiate the house price with a real estate agent is mirroring. Mirroring is repeating the keywords used by. Here are six tips for negotiating the best price on a home. 1. Get Prequalified for a Mortgage Getting prequalified for a mortgage proves to sellers that you'. If it was tough to get an offer accepted on a house with steep competition, you may not have much room for negotiation with your seller. Your real estate agent. 3. Try to Create a Bidding War When you hold open houses, you can increase competition among buyers. After listing the home on the market and making it.

How to negotiate real estate: Tips for every scenario · Selling rather than buying? · TIP: Negotiate the price but try not to offend the seller. · TIP: Use un-even. Be aware · Take help · Cash discounts · Show interest · Gauge the seller's need · Be prepared with funds · Every property deal is negotiable · Aim for a win-win. Asking for help from a professional will widen your options for houses within your financial capacity. Real estate agents collate houses depending on your. The one we find works best for us when you want to negotiate the house price with a real estate agent is mirroring. Mirroring is repeating the keywords used by. 8 Simple Rules for Negotiating Your Offer and Getting That House · #1 Act Fast — Like, Now · #2 Raise Your Price (Within Reason) · #3 Increase Your Earnest Money. This tactic will send prospective buyers running for the door. However, if you've researched how much homes in your area are selling for or have had your house. Here's How to Negotiate Your Best House Buy, Six Key Tips · 1. Get pre qualified for a mortgage · 2. Ask good questions · 3. Work back from a final price to. Real Estate Negotiation Tactics · 1. Show Your Cards Second · 2. Use Inclusions · 3. Connect Personally Through Letter Writing · 4. Use Affirming Language · 5. Leave enough room to negotiate with the seller. Tip: Offer an uneven amount e.g $, instead of $, Making an offer with an unusual amount will often. Furthermore, gathering essential information about the other party involved is crucial. Understand their motivation for buying or selling and their preferred. If this is the case, the buyer needs to come in with a stronger offer, within 10 percent of the asking price. If the property has been on the market for a while. 9 Homebuyer Strategies That Win Negotiation Stalemates · 1. Go into stealth mode. By being a tad sneaky, you can enter your negotiation more informed than the. 6 property negotiation tips you need to know · 1. Be ready · 2. Do your research into the property market, and the property you like · 3. Make the vendors a. Tips for negotiating a house purchase · Ask them what can help seal the deal – maybe they're hoping for a more extended closing, so they have time to move to. Here are six tips for negotiating the best price on a home. 1. Get Prequalified for a Mortgage Getting prequalified for a mortgage proves to sellers that you'. First rule of negotiating the purchase of a new-build · Before you start negotiating · Make sure the seller knows you have other options · Do your research before. How to Effectively Negotiate Buying a House · Is the house priced fairly to start with? · How long has the house been on the market? · Is it attracting a lot of. How to lower your closing costs · Seller concessions. Buyers can ask to have the sellers cover a portion of the costs (known as seller concessions). · Shop. But asking for this price reduction does not mean the seller will agree. If they do not agree, you have two choices: continue with the purchase as previously. Successful house price negotiation requires preparation, market knowledge, and the guidance of a skilled real estate agent.

1 2 3 4 5